Bookkeeping Spreadsheet for Amazon Sellers - Google Sheets and Excel - Designed by Accountant

Bookkeeping Spreadsheet for Amazon Sellers - Google Sheets and Excel - Designed by Accountant

Couldn't load pickup availability

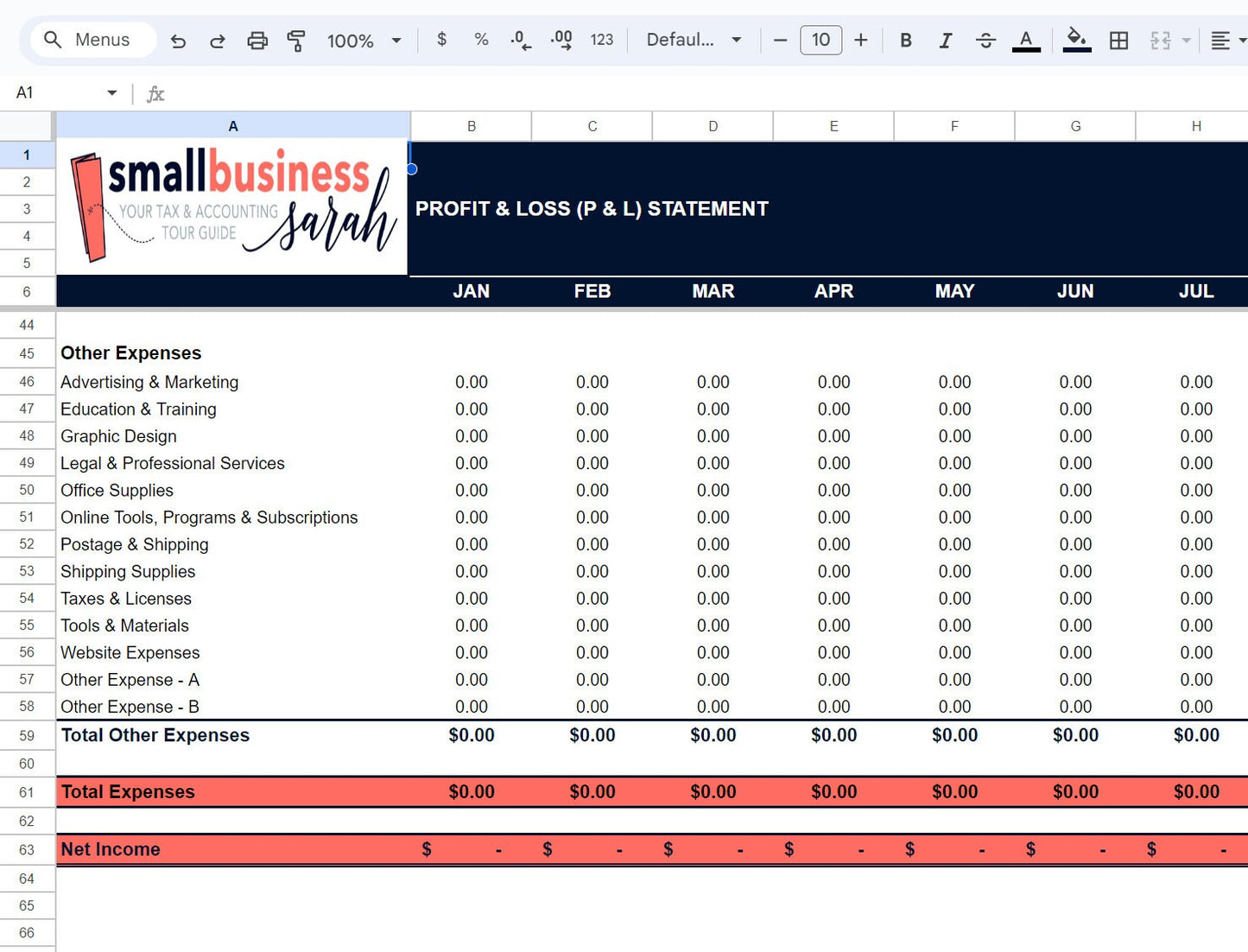

The easiest and most accurate bookkeeping spreadsheet for Amazon sellers! I'm an accountant and a bookkeeper for Amazon sellers, so I know exactly what you need to get easy, fast, and accurate financial information for your Amazon selling business. The charts and graphs provide quick insights into your Amazon selling profitability. When you use my spreadsheet, you will be ready come tax time, and you will know exactly how profitable your business was during the year. Don't use a generic spreadsheet, you won't get the right results!

Choose between the Google Sheets or Excel version of the spreadsheet. Both are the same, choose the one that works best for you!

Simply add your business expenses to the monthly tabs, grab a few numbers from an Amazon monthly summary page, and the spreadsheet will automatically calculate the income, expenses, and profit or loss of your business by month, and year to date.

An instruction PDF and video is included with your purchase, so you know exactly how to get the most out of your purchase.

IMPORTANT, PLEASE READ

-The spreadsheet product you are purchasing is in Google Sheet format and Excel format.

-This spreadsheet was designed for U.S. Based Sellers. The design of the spreadsheet and the tutorial video was made with U.S. Sellers in mind.

-Often U.S. Sellers are also selling on Amazon Canada and Amazon Mexico, this spreadsheet will allow you to track your Amazon income and expenses from these selling platforms as well.

-No refunds as this is a digital product.

-This product is ideal for newish Amazon sellers, or those who have less than 50 vendor purchases each month.

-This product is intended for business owners only selling on Amazon, and not selling in any other way or on any other platform.

Share